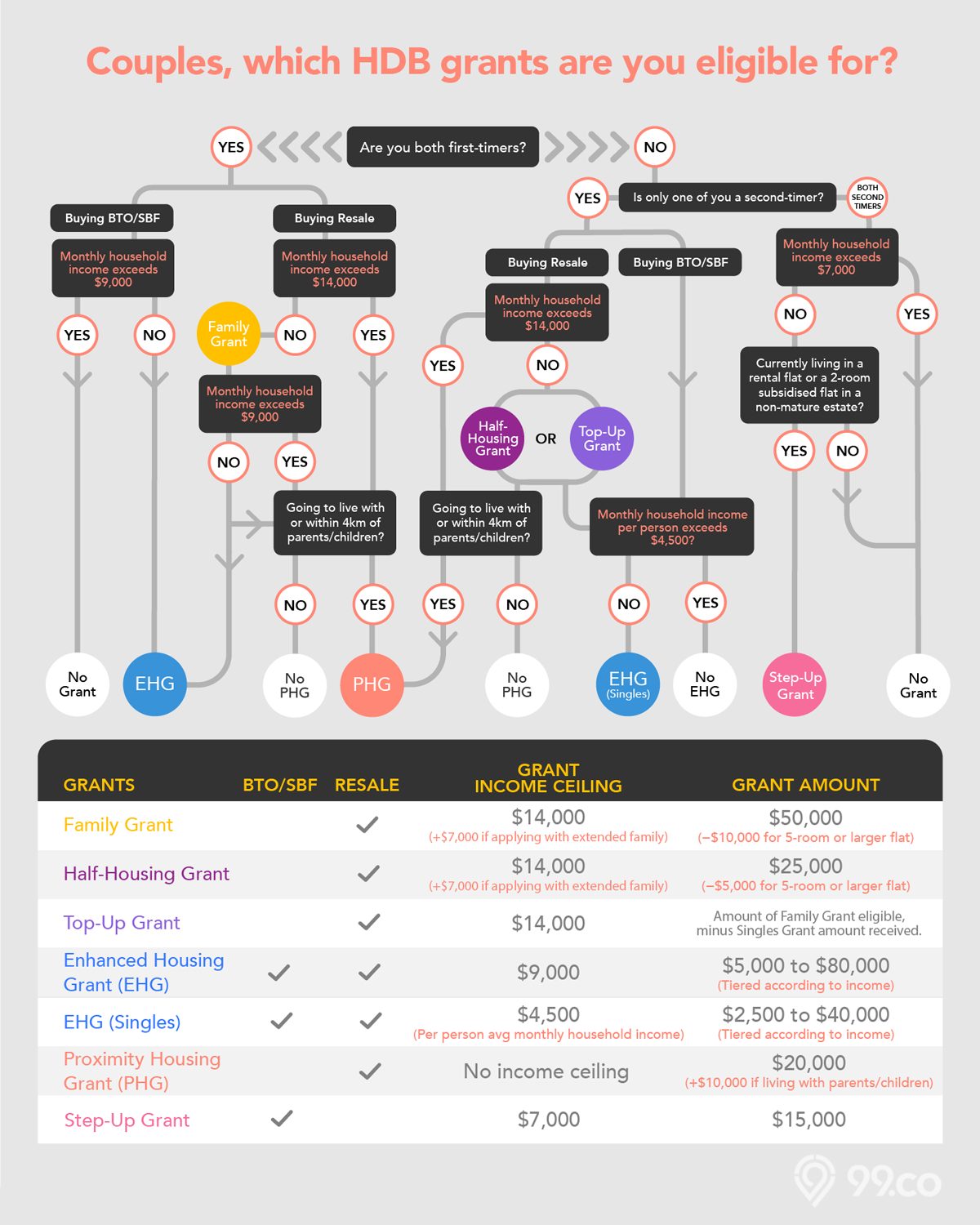

You might already know that there are various housing grants for couples to offset the cost of buying a new HDB home, be it BTO or resale. But it can be confusing trying to figure out which grant you’re eligible for, with different eligibility criteria and all. So here’s our quick-and-easy guide and infographic to help you make sense of grants and budget for your HDB flat.

Recommended YouTube Video

Various factors — such as household income — determine the HDB grant amount a couple can get. The key thing is that buyers of HDB resale flats are offered more grants than BTO (Build-to-order) and SBF (Sale of Balance Flats) applicants. This is because BTO and SBF flats are sold directly by HDB at a subsidised rate. (Open booking flats also fall under the same category as BTO and SBF flats.)

Now, let’s find out which grants you may be eligible for!

(If you’re on a mobile device, tap on the image to view the full-sized infographic and use two fingers to zoom in or out.)

(If you’re on a desktop browser, hold down ‘Ctrl’ and ‘+’ on your keyboard to magnify. To save the image, click on the image, then right click and select ‘Save image as…’.)

(If you’re on a desktop browser, hold down ‘Ctrl’ and ‘+’ on your keyboard to magnify. To save the image, click on the image, then right click and select ‘Save image as…’.)

HDB grants for couples: BTO/SBF/Open Booking flats

Technically, there’s only two grants available for BTO/SBF/Open Booking flats: the Enhanced Housing Grant (EHG) and the Step-Up Grant. (The EHG replaced the Additional Housing Grant (AHG) and Special Housing Grant (SHG) on 11 September 2019.)

Advertisement

The Step-Up Grant is reserved for a small group of low-income earners who want to step-up from a rental flat or a subsidised two-room flat.

Most BTO/SBF/Open Booking flat applicants would be looking at only the EHG, which is tiered according to household income, which means lower income households receive a higher EHG grant.

If both applicants are first-timers:

Income criteria for EHG:To qualify for the EHG or EHG (Singles), at least one of the applicants must have worked continuously for 12 months prior to the flat application, and must be working at the time of the flat application.

If one applicant is a first-timer, and the other a second-timer:

Here’s the table showing how the EHG is tiered for couples and singles:

| Enhanced Housing Grant for Couples | Enhanced Housing Grant for Singles | ||

| Average monthly household income | Grant amount | Average monthly household income | Grant amount |

| Not more than $1,500 | $80,000 | Not more than $750 | $40,000 |

| $1,501 – $2,000 | $75,000 | $751 – $1,000 | $37,500 |

| $2,001 – $2,500 | $70,000 | $1,001 – $1,250 | $35,000 |

| $2,501 – $3,000 | $65,000 | $1,251 – $1,500 | $32,500 |

| $3,001 – $3,500 | $60,000 | $1,501 – $1,750 | $30,000 |

| $3,501 – $4,000 | $55,000 | $1,751 – $2,000 | $27,500 |

| $4,001 – $4,500 | $50,000 | $2,001 – $2,250 | $25,000 |

| $4,501 – $5,000 | $45,000 | $2,251 – $2,500 | $22,500 |

| $5,001 – $5,500 | $40,000 | $2,501 – $2,750 | $20,000 |

| $5,501 – $6,000 | $35,000 | $2,751 – $3,000 | $17,500 |

| $6,001 – $6,500 | $30,000 | $3,001 – $3,250 | $15,000 |

| $6,501 – $7,000 | $25,000 | $3,251 – $3,500 | $12,500 |

| $7,001 – $7,500 | $20,000 | $3,501 – $3,750 | $10,000 |

| $7,501 – $8,000 | $15,000 | $3,751 – $4,000 | $7,500 |

| $8,001 – $8,500 | $10,000 | $4,001 – $4,250 | $5,000 |

| $8,501 – $9,000 | $5,000 | $4,251 – $4,500 | $2,500 |

| More than $9,000 | NA | More than $4,500 | NA |

Source: HDB

Advertisement

If both applicants are second-timers:

If one applicant is a not a Singapore Citizen (Non-Citizen Spouse Scheme):

HDB grants for couples: Resale flats

If both applicants are first-timers:

Income criteria for EHG:To qualify for the EHG or EHG (Singles), at least one of the applicants must have worked continuously for 12 months prior to the flat application, and must be working at the time of the flat application.

One applicant is a first-timer, and the other is a second-timer:

For applicants who have previously received a Singles Grant:

*Exception: For Singapore Citizen/Singapore Permanent Resident (SC/SPR) households with the SPR spouse now obtaining Singapore Citizenship status, they are eligible for a Citizen Top-Up Grant of $10,000 with no maximum household income restrictions, although they are subject to other criteria.

For applicants buying a resale flat to live with their parents/children or within 4km of their parents/children:

For more information about HDB resale grants, check out our detailed article: HDB Resale Grants: How much can you get?

Advertisement

What if one of the applicants has yet to graduate/ORD from National Service?

HDB announced in May 2018 that income assessment can be deferred until key collection for full-time National Servicemen (NSFs) and student applicants who are at or above the eligibility age of 21 and above. The deferment of income assessment for these couple applicants still qualifies them to apply for the Enhanced Housing Grant (EHG).Full details on the Deferred Income Assessment here.

How will the HDB grants for couples be disbursed?

All grants are credited into the CPF Ordinary Accounts (CPF-OA) of eligible Singapore Citizen applicants. For Singapore citizen couples, the grant amounts are split equally among the two CPF-OAs. No cash is disbursed.

3 days ago · 6 min read · Source: 99.co (16 Jun 2020)

Advertisement

Recommended YouTube Video