The key issues to watch for in 2019

1. Home loan rates continue to climb

We heard some grumbling on 25th August last year, when DBS hiked their 8 month FHR home loan package. This raised borrower’s home loan interest rates from 1.65 per cent to 1.95 per cent per annum. This was specifically due to the US Federal Reserve raising its rates, and you can expect other banks are following suit.

There’s something of a history behind our cheap home loans, and why they’re vanishing:

After the Global Financial Crisis in 2008/9, the US Federal Reserve set interest rates to zero. This caused Singapore home loans to fall to historical lows – bank home loans have been cheaper than even HDB loans for almost a decade now (at present, they are about 1.8 to two per cent per annum, compared to HDB’s 2.6 per cent).

However, the Fed cannot sustain low interest rates indefinitely. They have been raising it in 0.25 per cent increments, up to 1.75 per cent last year. They’ve since lowered their projection of three rate hikes to two for 2019 – but it’s nothing for Singapore’s borrowers to cheer about.

Two more rate hikes still mean that home loan interest rates will go up. And given that rates have been at record lows for almost 10 years, they have nowhere left to go but up: it’s part of an ongoing trend that’s not going to stop this coming year or the next*.

Note that the historical interest rats for Singapore home loans is around four per cent per annum (although we’re probably a long time away from returning to that).

*Barring bizarre, black swan events that force the Fed to adapt again.

2. District 19 leads the way this year

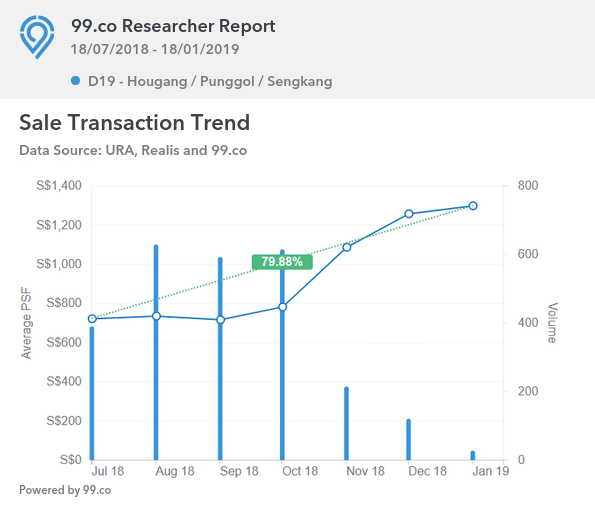

District 19 covers the areas of Punggol, Sengkang, and Serangoon Gardens. Over the past six months, we’ve seen significant upswings in residential prices across D19:

Average PSF has risen from $735 psf to $1,298 psf, a dramatic increase of nearly 80 per cent.

The can be partly attributed to three new launches in 2018: Garden Residences, Affinity, and Riverfront Residences. However, Garden Residences and Affinity actually suffered from low initial take-up rates. Also, this is an unusual situation in that prices are going up, despite rising supply.

Agents we spoke to were divided on the reason. Some said that resale units are raising their prices, in response to seeing the price points of the new launches.

Others pointed out that Serangoon is simply a developing area, with increasing amenities. They pointed out that during the first half of 2018, for example, D19 also recorded the highest number of deals for landed properties, and topped the charts for detached houses.

3. It’s time to give up on en-bloc dreams for the year

The recent cooling measures mean that developers now pay 25 per cent ABSD, plus five per cent that is non-remittable. This makes collective sales a much more expensive prospect.

On top of that, developers have to contend with Development Charge (DC) hikes. In September last year, these rose by three to 33 per cent across 75 sectors. The hike makes it more expensive for developers to start new projects.

Even setting aside these two big factors, developers must contend with buyers taking a “wait and see” approach, following the last cooling measures. This can make it difficult for them to fully sell and complete their units by the five year deadline (for ABSD for developers), or the effectively seven year deadline for the Qualifying Certificate (QC).

As of December 2018, no less than 30 en-bloc sales failed to find buyers. Of these, half of them lowered their asking price.

If there are any en-blocs this year, they will likely be for smaller plots of land, where developers have the confidence to quickly finish and sell off all the units.

4. Tenants have the upper hand, despite a slight rental market recovery

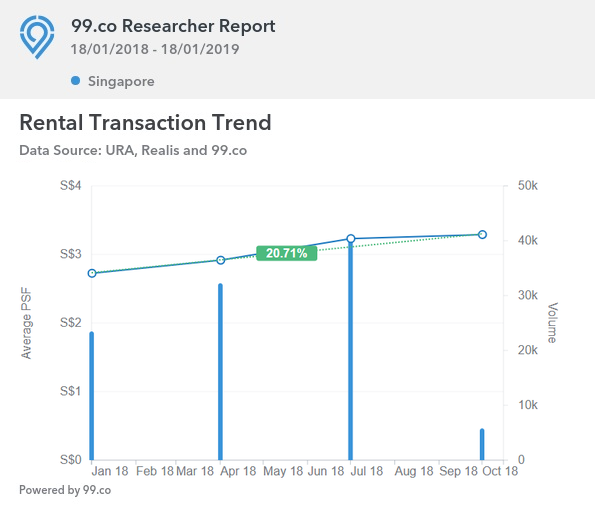

Island-wide, rental rates gone up over the past year. We’ve gone from an average of $2.72 psf to $3.29 psf today – about a 20.7 per cent increase:

However, landlords aren’t out of the woods yet. There’s a lot of supply incoming for 2019 and 2020, largely thanks to frenzied en-bloc sales back in 2017. According to the government, supply in the pipeline stands at about 45,000.

As such, we believe it remains a tenant’s market, and will remain so throughout 2019 despite the slight uptick in rental rates. You can search for the best rental rates by location on 99.co.

5. Brace for global tensions to impact our property market

There is an indirect connection between global trade tensions, and the ultimate impact on our property market. There are two things to watch for here.

First, we need to brace for the possibility of companies shrinking expatriate packages, and trying to hire locally instead. This will reduce the number of prospective tenants, particularly for the D9 and D10 properties that are highly dependent on affluent expats.

In particular, there are ongoing fears about a slump in oil pricesdue to oversupply. If this happens, it could impact Singapore’s oil and gas industry, and potentially our finance industry (energy companies tend to be highly leveraged). These two sectors bring in a lot of affluent, prospective tenants.

Second, foreign investors are likely to turn cautious in the current climate of geopolitical confusion. That could be especially true for Singapore, as we’re known to be dependent on high levels of global trade. Foreign investors might want to sit out the year rather than invest in local properties, particularly with issues like a no-deal Brexit hanging over us.

Come to think of it, local investors might too.

Once again, we’d like to remind you that home buyers don’t need to worry too much about any of this.

These issues are for investors to contend with. For home buyers, you should stay focused on the basics: a home that suits your needs, at a price that matches your financial situation. You can find the best priced properties in any neighbourhood on 99.co.

Do you think 2019 will be a good year for our property market? Voice your thoughts in our comments section or on our Facebook community page.

3 days ago · 7 min read · Source: 99.co (21-Jan-2019)